Understanding how to use and when to use Modified Endowment Contracts (MECs) is something that can really differentiate you from your competition.

From The Advisor

"The NFG Team was able to provide an unexpected solution to my client's situation and helped me bring in more assets under management as a result."

Client

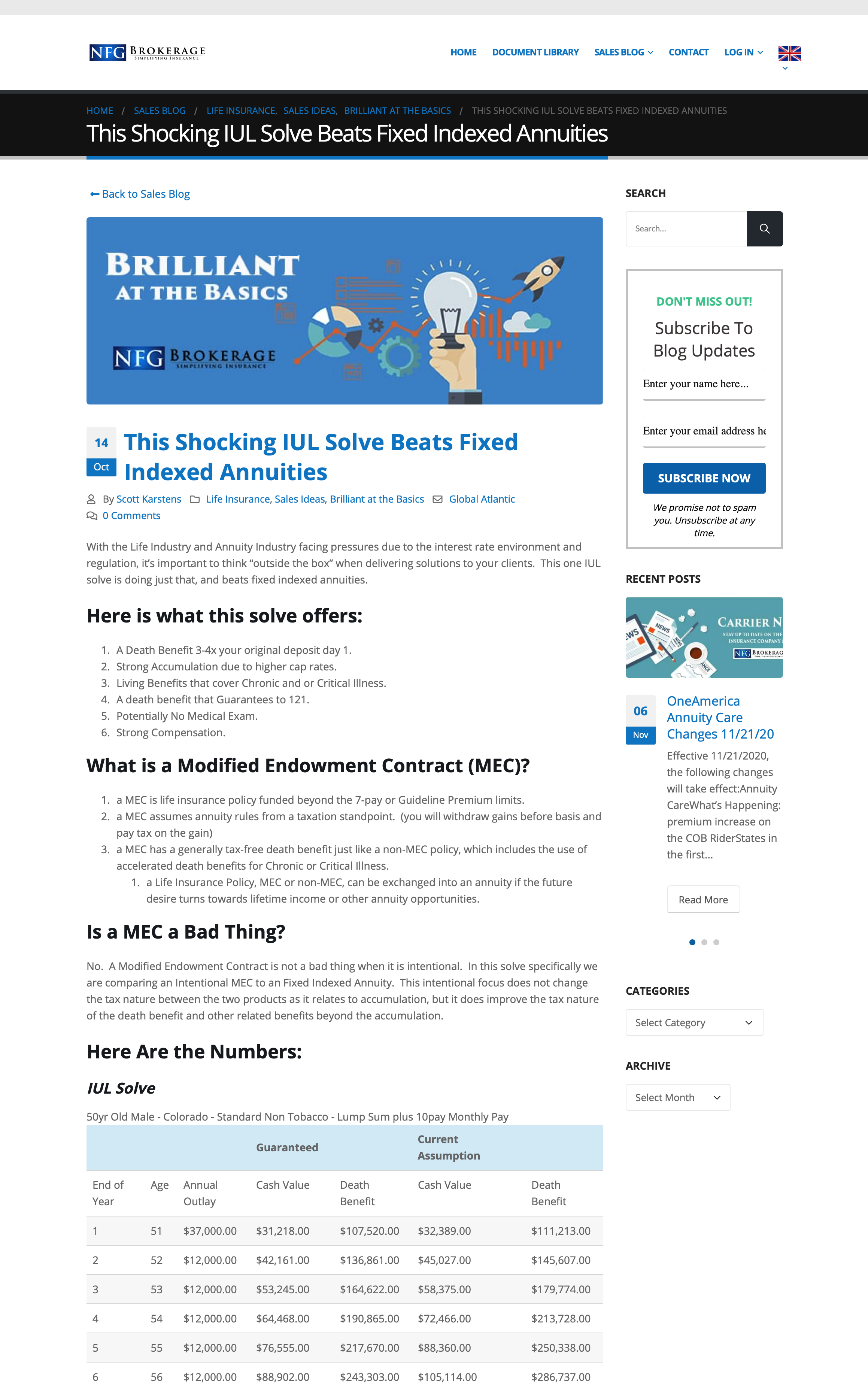

Male age 50, Colorado

Challenge

The client is not sure whether and income annuity, death benefit annuity, or accumulation annuity is best. They have around $37,000 in funds to allocate in year one, and they are willing to save $1,000 per month for the next 10yrs.

Solution

A dynamically innovative solution to the accumulation space utilizing a Modified Endowment Contract (MEC). You decide to provide the client a life insurance policy designed as an intentional MEC that provides the client better accumulation potential, better death benefit, can be transfer to an annuity in future years if income becomes more of a necessity.

Results

Using the same deposits, we were able to provide 3% more accumulation by age 64, 115% more death benefit (before factoring in the improved tax efficiency of the life insurance death benefit), more than $400,000 of Chronic Illness Coverage and $100,000 of Chronic Illness coverage.